Renters Insurance in and around Clemson

Welcome, home & apartment renters of Clemson!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

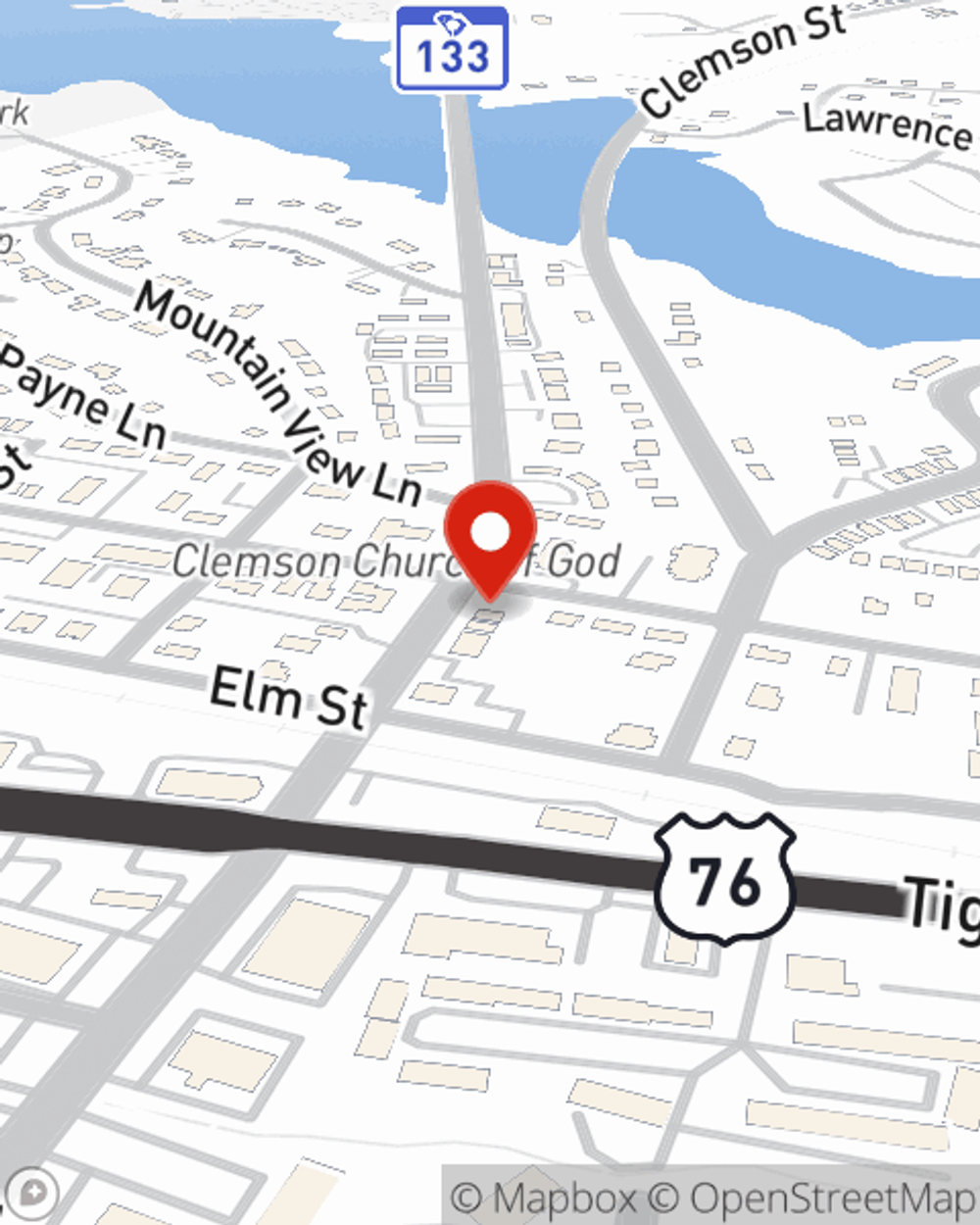

- Clemson, SC

- Central, SC

- Seneca, SC

- Pickens County, SC

- Anderson, SC

- Pendleton, SC

- Easley, SC

- West Union, SC

- Walhalla, SC

- Pickens, SC

- Liberty, SC

- Greenville, SC

- Fountain Inn, SC

- Travelers Rest, SC

- Norris, SC

- Honea Path, SC

- Oconee County, SC

Calling All Clemson Renters!

It may feel like a lot to think through work, managing your side business, your sand volleyball league, as well as savings options and deductibles for renters insurance. State Farm offers no-nonsense assistance and terrific coverage for your furnishings, souvenirs and furniture in your rented space. When trouble knocks on your door, State Farm can help.

Welcome, home & apartment renters of Clemson!

Renting a home? Insure what you own.

There's No Place Like Home

Renters insurance may seem like last on your list of priorities, and you're wondering if having it is actually beneficial. But take a moment to think about what it would cost to replace all the personal property in your rented apartment. State Farm's Renters insurance can help when thefts or accidents damage your valuables.

State Farm is a value-driven provider of renters insurance in your neighborhood, Clemson. Get in touch with agent Gene Dukes Jr. today for a free quote on a renters policy!

Have More Questions About Renters Insurance?

Call Gene at (864) 638-1052 or visit our FAQ page.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Gene Dukes Jr.

State Farm® Insurance AgentSimple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.